In a transformative push for digital transactions, Bihar has emerged as a key player in the adoption of Electronic Point of Sale (ePOS) systems across the state. On October 15, 2023, the Bihar government announced a statewide initiative to equip over 50,000 small merchants with ePOS devices, aiming to boost cashless payments in rural and urban areas. This move, centered in Patna, targets financial inclusion for underserved communities. Why now? With India’s digital economy booming, officials see ePOS in Bihar as a gateway to economic empowerment. This development promises to reshape how transactions unfold daily.

ePOS in Bihar: A Game-Changer for Small Merchants

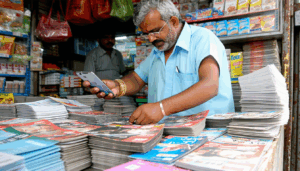

The rollout of ePOS systems in Bihar marks a significant step toward modernizing the state’s retail sector. Under the new initiative, merchants in districts like Patna, Gaya, and Muzaffarpur are receiving subsidized devices to facilitate card and mobile payments. The government aims to cover 80% of small businesses by mid-2024. According to tech expert Anil Sharma, “This is a pivotal moment for Bihar’s economy. It bridges the gap between traditional markets and digital platforms.”

Over 30,000 devices have already been distributed since the program’s launch last month. This rapid deployment highlights the urgency to integrate rural vendors into the digital fold. The impact is immediate—merchants report a 20% uptick in sales due to easier payment options. Yet, challenges like limited internet access in remote areas remain a hurdle.

Impact on Financial Inclusion and Local Economy

The push for ePOS in Bihar directly addresses the state’s low banking penetration, where only 40% of adults have access to formal financial services. By enabling digital payments, the initiative allows unbanked individuals to participate in the broader economy. Transactions through Unified Payments Interface (UPI) linked to ePOS devices have surged by 15% in pilot areas since September 2023.

Local shopkeeper Rakesh Kumar from Gaya shared his experience: “Customers now pay with phones or cards. My business feels more secure without handling cash.” Economists predict this shift could add $50 million annually to Bihar’s digital transaction volume. However, some merchants worry about transaction fees cutting into slim profit margins.

Beyond economics, the program fosters trust in digital systems among skeptical rural populations. Government-backed training sessions are helping users adapt to the technology. Still, stakeholders stress the need for robust cybersecurity to protect against fraud.

Challenges and Future Outlook for Digital Payments

While the initiative shows promise, it faces significant obstacles. Poor network connectivity in rural Bihar disrupts ePOS functionality, frustrating both merchants and customers. Additionally, only 60% of targeted vendors have received training, leaving many unprepared to handle the systems.

According to policy analyst Priya Mehra, “Infrastructure must keep pace with ambition. Without reliable internet, ePOS risks becoming a burden rather than a boon.” The government has pledged to address these gaps by partnering with telecom providers to expand 4G coverage by 2025.

Looking ahead, the success of ePOS in Bihar could inspire similar programs in other Indian states. If scaled effectively, this could redefine retail across the nation’s hinterlands. Yet, balancing cost, accessibility, and education will be critical to sustaining momentum.

Analysis and Conclusions

The rise of ePOS in Bihar underscores a broader national trend toward digitization, aligning with India’s vision of a cashless economy. Its significance lies in empowering small merchants and integrating marginalized communities into mainstream finance. However, uneven infrastructure and awareness pose risks that could derail progress if not addressed swiftly.

On one hand, proponents argue that digital payments enhance transparency and reduce corruption tied to cash dealings. On the other hand, critics caution against over-reliance on technology in areas lacking basic connectivity. Both perspectives highlight the need for a balanced approach.

In summary, Bihar’s ePOS initiative is a bold stride toward financial inclusion. Its early success signals potential for widespread economic upliftment. As challenges are tackled, this could become a model for transforming India’s retail landscape.

Frequently Asked Questions (FAQs)

What is the purpose of the ePOS initiative in Bihar?

The initiative aims to promote digital payments among small merchants, enhancing financial inclusion and boosting the local economy.

How many merchants are targeted for ePOS device distribution?

Over 50,000 small merchants across Bihar are set to receive subsidized ePOS devices by mid-2024.

What challenges does the program face?

Key issues include poor internet connectivity in rural areas and insufficient training for merchants using the systems.

How does ePOS benefit local businesses in Bihar?

It enables easier transactions via cards and mobile payments, increasing sales and reducing cash-handling risks.

What is the future potential of ePOS in Bihar?

If successful, it could serve as a blueprint for other states, reshaping retail and digital payments nationwide.